Thursday, March 21, 2013

Fun debt graphs

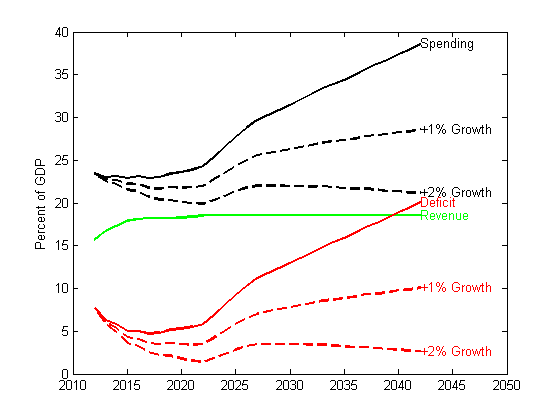

Above, I plot the CBO's long term outlook, in the alternative fiscal scenario (i.e. the one that is even faintly plausible). As you can see, though they think the deficit gets better for a bit, then the entitlements disaster is still with us.

Of course, this will not happen, the only question is what adjusts. If bond markets get a whiff that we actually will try these paths, we have a crisis on our hands.

So what can adjust? Revenue is historically about 20% of GDP no matter what tax rates are. Doubling Federal revenue, while of course states, cities and counties keep taxing us, seems like an unlikely prospect. I'm all for cutting spending, but really, cutting spending in half, and by more than 20 percentage points of GDP? Well, it's in the Ryan budget, but it's a lot. So, what else can we do?

Answer: Growth. Tax revenue equals tax rate times income, and income equals todays income times growth. Greater growth makes all the difference.

To illustrate this point, I made a simple calculation. Suppose growth is 1% and then 2% greater than the CBO projects. What effect does that have? To keep it very simple, I assume that spending stays the same, and revenue stays the same fraction of GDP. Thus, I just divide spending/GDP by a 1% and then 2% growth rate (e^(0.01 t)) and we have the new spending as a fraction of the larger GDP.

This is pretty amazing, no? If we just had two percentage points GDP growth greater than the CBO's forecast (which is a bit above 2% in the out years) the whole budget would be solved without fixing anything.

This thought sent me back to look at the CBO's economic assumptions,

Uh-oh. The CBO thinks we are going to quickly enter a period of 4% growth, go back to trend, and then start growing smartly. Tax revenue = tax rate x income, that's a lot of revenue. The CBO, the Fed, and everyone else (me too for a few years) has been forecasting this bounce back growth just around the corner for a while now. What if it doesn't happen, and 1.5% growth without catching up to trend is the new normal?

To keep it simple, I redid the above chart now just assuming 1% and 2% less growth than the CBO.

Is that Greece, or Cyprus?

So, the real budget news that could matter has little to do with tax rates or spending. What matters most of all is whether we break out of this sclerotic growth trap.

I found this graph pretty chilling as well:

Really, what chance do you think there is that defense, nondefense discretionary and other mandatory spending will decrease form 4% of GDP to 2.5-3% of GDP in 10 years?

The net interest line is interesting. That's a huge rise. Why? Here are the other economic assumptions

You see the strong GDP growth, 4% for several years, in the top left panel. Inflation, bottom left, apparently has nothing to do with deficits, the Phillips Curve is alive and well.

But, the CBO is projecting interest rates to rise sharply in 2016, back to a low-normal 4% 3 month and 5% 5 year rate. This causes the $850 billion a year in interest costs highlighted in the previous graph, about the same numbers I was bandying about in "Monetary Policy with Large Debts" when worrying whether the Fed could actually do that to deficits.

From the deficit view, a Japanese lost decade of low interest rates would keep this from happening (or postpone it). Of course any financial event leading to higher interest rates would increase these interest payments a lot.

Monday, March 18, 2013

Growth in the UK?

So I was glad to read the tiltle, when a friend sent me a link to the Telegraph, announcing Osborne to unleash raft of policies to kick-start growth. Great, I thought, after trying everything else, the British will finally try the one thing that will work.

The byline was only a bit disappointing

The Government is to reveal a series of major new measures to boost national and regional growth ahead of the Budget to show its “pro-business” strategy is workingPro-business is usually a code word for protection and subsidy. But there are plenty of worse code words.

And then it all falls apart

The measures will include:It's not all bad. Allowing a nuclear power plant to operate is nice, and some plans to lower corporate taxes a bit. But the blossoming of free enterprise in the land of Adam Smith, alas, this is not. Keynes still rules.

• Billions of pounds of central government funding directed at boosting regional growth and a backing for Michael Heseltine’s plans for new local spending powers;

• The planning go-ahead for the Hinkley Point C nuclear power station;

• Support for housebuilders and for first-time buyers trying to get mortgages;

• A push on major infrastructure projects, including the Merseyside Gateway and the “super-sewer” in London, and more government guarantees for such projects;

... The Bank of England could also be given a broader mandate to support growth.

...billions of pounds of central government funds should be made directly available to the regions and cities such as Birmingham...

Lord Heseltine’s report made far-reaching recommendations for stimulating economic growth. The Government will unveil plans enabling Local Enterprise Partnerships and businesses to bid regionally for money that is now allocated centrally.

The fair price of catfish in Vietnam

|

| Source: Wikipedia |

Lovers of free markets and free trade, this is for you. Fry it with a little hot sauce.

Who gets hurt here? US catfish consumers. Who is that? Hint: catfish isn't on the menu in fancy Washington DC restaurants, or even at Spiaggia here in Chicago.

Well, I'm glad we can come to bipartisan agreement -- Republican Congressemen and Senators, and the Administration's trade apparatus -- to take money out of the pockets of relatively poor catfish consumers.

I'm interested in the language and rhetoric that we use to describe economic policy. I highlighted some particularly interesting words and phrases (all emphasis mine.)

Press release from Senator Jeff Sessions:

Commerce Department Will Enforce “Fair Value” Pricing, Protect Alabama Catfish Industry Following Letter Organized By Sessions Thursday, March 14, 2013Congressman Rick Crawford:

WASHINGTON—U.S. Sen. Jeff Sessions (R-AL) commented on a decision today from the Commerce Department regarding the need to protect Alabama’s catfish industry from unfairly priced Vietnamese imports and non-market economies. Sessions organized a bipartisan letter to the Commerce Department to urge them to take action.

“Domestic production and fair value pricing are essential aspects of a sound economy. [JC: "fair value pricing?"] I am very encouraged by the findings of the Commerce Department’s 8th Administrative Review. This decision is a step in the right direction to protect US workers and our catfish industry in Alabama. [JC: What happened to the US catfish consumer?] The dramatic catfish production decrease over the last decade can be directly attributed to unfairly priced imports, leaving our local catfish farms at risk. The Commerce Department’s decision to use Indonesia as a surrogate country for Vietnam helps correct unfair competition and ensures that jobs and industry in our state are protected. [JC: well, there you have it. The goverment's job is to "protect industry."] By enforcing our nation’s trade laws, and fostering an environment that requires healthy competition, I am confident that our local catfish farms will again be a market leader.”

BACKGROUND: On February 7, Sessions organized a letter signed by Senate colleagues, Richard Shelby, Thad Cochran, Roger Wicker, Mark Pryor, John Boozman, David Vitter, and Mary Landrieu regarding the 8th Administrative review, from the Department of Commerce, determining “fair value” pricing for Vietnamese producers’ frozen fish fillets. The Department of Commerce uses surrogate countries to determine the fair value of products for non-market economies. In previous reviews, the Department of Commerce has used Bangladeshi data to set the market price for the Vietnamese producers’ fish fillets despite industry proposals for a surrogate nation with higher quality data available, such as the Philippines or Indonesia. The Bangladeshi prices range from $0.29/lb-$0.43/lb whereas the U.S. price is about $0.80/lb. The lower rates have had significant negative effects on the US market and this continued approach would bolster the volume of Vietnamese frozen fish fillets to the detriment of the United States industry.

Today, the Department of Commerce announced that Indonesia would be used as a surrogate country for Vietnam to best calculate the price per pound of frozen fish fillets. This decision helps ensure that Vietnamese production will be subjected to appropriate and reasonable standards and that domestic catfish producers will not be victims of unfair pricing.

Washington, Mar 14 -Maybe we should feel a bit sorry for Sessions and Crawford. At least other senators get to lobby for real money, like bank bailouts.

Today, Congressman Rick Crawford (R-AR) welcomed news for the U.S. Catfish industry after the Commerce Department issued their final results of the 8th Administrative Review of the antidumping duty order on Certain Catfish Filets from Vietnam. The results indicate that Vietnamese catfish will face fair antidumping duties when imported into the domestic U.S. market. For years, the Commerce Department has been unfairly assigning a near-zero antidumping duty on Vietnamese Catfish, which has led to unfair competition, and a flood of Vietnamese imports. Since 2008, Vietnamese imports of catfish fillets have tripled, and have taken nearly 80 percent of the domestic market. The Department decided to switch from a Bangladeshi surrogate value to Indonesian price index for calculation of antidumping duties...

Crawford issued the following statement after hearing the welcome news:

“For too long, the Arkansas catfish industry has faced unfair competition from non-market economies, such as Vietnam. I am pleased to hear that the Commerce Department heeded my call to assign a fairer price calculation to the value of Vietnamese Catfish. This is a win for the U.S. Catfish industry and the Delta region in the First District of Arkansas. [JC: and noticeably not a win for US catfish consumers] I am confident that the Commerce Department’s decision to fairly enforce our trade laws is a great first step towards a U.S. catfish industry recovery that will create jobs and grow the Delta economy.”

The Department of Commerce memo is worth reading too. Sometimes it's worth seeing just what goes in to our Federal sausage

The product covered by the order is frozen fish fillets, including regular, shank, and strip fillets and portions thereof, whether or not breaded or marinated, of the species Pangasius Bocourti , Pangasius Hypophthalmus (also known as Pangasius Pangasius ), and Pangasius Micronemus .

Frozen fish fillets are lengthwise cuts of whole fish. The fillet products covered by the scope include boneless fillets with the be lly flap intact (“regular” fillets ), boneless fillets with the belly flap removed (“shank” fillets), boneless shank fillet s cut into strips (“fille t strips/finger”), which include fillets cut into strips, chunks, bl ocks, skewers, or any other shape. Specifically excluded from the scope are frozen whole fish (whether or not dressed), frozen steaks, and frozen belly-flap nuggets. Frozen whole dressed fish are beheaded, skinned, and eviscerated. Steaks are bone-in, cr oss-section cuts of dressed fis h. Nuggets are the belly-flaps. The subject merchandise will be hereinafter referr ed to as frozen “basa” and “tra” fillets, which are the Vietnamese common names for these species of fish.It goes on like this for 54 mind-numbing pages. A random excerpt

Bangladesh is a significant producer of identical merchandise pangasius hypophthalmusThe life of a planner is a hard one.

...The production experiences of pangasius producers in Bangladesh replicates those of the Vietnamese respondents in that produce pangasius through commercial pond-based aquaculture. This directly implies that the cost of production, related expenses, and revenues for pangasius farmers in Vietnam and Bangladesh are very similar.

In Indonesia, only 70 percent of the 2011 pangasius production is from ponds, and the record is unclear as to what proportion of the Indonesian pond based aquaculture production is accounted for commercial-based pond aquaculture as opposed to homestead-based pond aquaculture.

I do feel for the producers. I hope someone knowledgeable will write in, answering the question: what else can you do with a catfish farm? Is it possible to change from catfish to, say, genetically engineered salmon? Trout? Caviar sturgeons? Usually when low-price low-quality competitors appear (and frozen catfish from Vietnam is clearly that), the answer for a domestic producer (if Congress doesn't protect it) is to change to high-value skill-intensive products.

Capital not a lost cause?

There is growing talk among regulators, for example, of forcing banks to issue a minimum amount of long-term debt, cap the size of their short-term liabilities or restrict activities that can be conducted within regulated bank subsidiaries.OK, 3 out of 4 ain't bad. Admati and Hellwig (and I) take a dim view of asset risk regulation and the chance that regulators have any hope of seeing bubbles emerge. But more capital, and more people understanding that leverage and TBTF is a subsidy to banks, so banks are forced to fight about it... that's progress.

At the same time, regulators seem to be focusing more on the need to pre-emptively address potential systemic risks.

Any such moves could further constrain banks' ability to juice returns through leverage while also limiting lucrative activities that fall outside a traditional lending function. That could subdue earnings growth already hampered by the superlow interest-rate environment.

The danger isn't lost on banks themselves. A number of banking groups recently joined together in a public attempt to rebut notions of a big-bank borrowing subsidy.”

Thursday, March 14, 2013

GMO Salmon

|

| Source: http://www.aquabounty.com |

"In 1993, the company approached the Food and Drug Administration about selling a genetically modified salmon that grew faster than normal fish. In 1995, AquaBounty formally applied for approval. Last month, more than 17 years later, the public comment period...was finally supposed to conclude. But the F.D.A. has extended the deadline...Why the delay?

Appropriately, it has been subjected to rigorous reviews... scientists, including the F.D.A.’s experts, have concluded that the fish is just as safe to eat as conventional salmon and that, raised in isolated tanks, it poses little risk to wild populations.

... some suspect that political considerations have played a role in drawing the approval process out to tortuous lengths. Many of the members of Congress who oppose the modified fish represent states with strong salmon industries. And some nonprofit groups seem to be opposing the modified salmon reflexively, as part of an agenda to oppose all animal biotechnology, regardless of its safety or potential benefits.namely,

Even the White House might be playing politics with the salmon. “The delay, sources within the government say, came after meetings with the White House, which was debating the political implications of approving the GM salmon, a move likely to infuriate a portion of its base.”

anti-biotech groups, which traffic in scare tactics rather than science...This story brings three thoughts to mind.

1. So who is "anti-science?" I can't resist. There were a lot of potshots at Republicans for being anti-science, some well-deserved. But "science" is abundantly clear here. "Science" is indeed wrong at times, but if we want policy based on "science," the safety of GMO foods is about as good as it gets. There's plenty of magical thinking on both left and right, it turns out.

2. $10,000 dollars invested in the stock market in 1993 is worth $50,000 today ($31,477 after inflation) yes, even after the crash. It was already worth $37,600 ($32,700 after inflation) in 1999. Remember, AcquaBounty hasn't sold a single fish. The cost of 20 years delay is enormous, amounting to a huge tax disincentive.

3. We need growth. Where does growth come from? Modern growth theory is abundantly clear. New ideas, new processes, new businesses that raise productivity. Like a new idea that lets us double the growth rate of farmed salmon. And, yes, lower profits of current salmon fishermen, much to the relief of wild salmon.

GMO foods are, potentially, a huge game changer. Once every 50 years or so, we bump up against a Malthusian limit, and a new idea frees us again. Fixing airborne nitrogen. Green revolution. Now, GMO foods. GMO plants are being bred to use less fertilizer and insecticide, i.e. to be better for the environment, as well as to cure vitamin A deficiency, produce less waste, and so on. No, dear Greenpeace, organic farming is not the answer, unless we use a lot more land for agriculture, starve out half the people, or believe in magic. (It's too bad organizations like this suffer such mission creep. I would happily support their efforts on behalf of endangered species.)

Or maybe not. The lesson of industrial policy is that academic bloggers are just as bad as government bureaucrats in finding the next game changer. But there are hundreds of similar game-changers underway. Read any popular science magazine. Will we let the winners bear fruit?

Why do countries and civilizations fail? When interests vested in the status quo or magical thinking stop that process. A long decay precedes the crises. I am reminded of the famous failures, such as the Chinese Emperor's ban on long-range shipping, at a time when Chinese ships were way better than Portugese.

Update: A very nice article by Henry Miller on GM foods, titled "Anti-Genetic Engineering Activism: Why the Bastards Never Quit." Henry is obviously much more knowledgeable than I am.

Taxation of capital and labor

His one-sentence summary

Under standard, pretty flexible assumptions, it's impossible to tax capitalists, give the money to workers, and raise the total long-run income of workers. Not, hard, not inefficient, not socially wasteful, not immoral: Impossible.

Tuesday, March 12, 2013

Challenges in Transitioning Away From Your BD

My securities law practice involves most every aspect of the brokerage industry, and at various times I represent a significant number of brokers who are leaving their broker-dealers, for what they hope are greener pastures. Over the years I have assisted brokers in all sorts of transitions - firm to firm, firm to independent firm, firm to investment adviser firms - even starting their own investment advisory firm.

While every situation is somewhat unique, brokers face the same challenges in the transition process - some of those challenges are legal, some are business oriented. While I believe I have faced and dealt with every challenge over the years, I thought my readers and clients might find this article, by a Phillip Flakes, who assists brokers in finding, and partnering with new financial firms, helpful in identifying those issues.

If you are considering a move, take a few minutes to review this article, which presents the business side of the issues. Then, while I am better known for the litigation side of the transition process, in particular the defense of promissory note cases, if you decide to make a change, give me a call to seek how I can assist you in that transition. Ligitation is not always the answer - careful planning can often avoid litigation.

I am available by phone at 212-509-6544 or by email - astarita@beamlaw.com.

Identifying and Overcoming the Challenges of Transitioning.

Saturday, March 9, 2013

State Regulators Attempting to Ban Customer Arbitration

This new push to end arbitration is curious for two reasons First, it completely ignores the fact that it is the SEC which created the setting for mandatory arbitration of customer disputes. In the 1970s, the SEC approved a rule by the NASD which required all brokerage firms, and all individual brokers, to arbitrate their disputes with each other, and with any customer. The SEC thereby created a system where a customer could force a firm to arbitrate, but the firm, and its employees, did not have the same right. As a reaction to that government mandate, the industry began using predispute arbitration agreements, which the United States supreme Court has ruled are valid.

The second problem with the proposal is the fact that while the state administrators are supposedly concerned about investors' rights to trials and "fair" hearings, they have completely ignored the fact that the SEC and FINRA require over 600,000 brokerage firm employees to arbitrate their disputes with customers and with their employers. I am unawre of any other industry where the government requires employees to arbitrate their disputes with their employer.

Not really a surprise though, as the NAASAA is apparently a bit out of touch. Consider this quote from the same InvestmentNews.com article, and keep in mind that the markets are hitting record highs:

In discussing the misquided attempt to ban arbitration agreements, the head of the Arkansas Securities Commission said that allowing investors flexibility in settling claims is central to increasing their confidence in the financial markets.

“Harmed investors should be able to seek relief in any forum and not be forced into an expedited arbitration that could foreclose their ability to obtain relief . . . Investors aren't going to invest if they can't sue if they're defrauded. It's as simple as that.”

Putting aside the mistaken notion that "expedited arbitration" forecloses the ability to obtain relief, one has to wonder with the market hitting record highs, which investors the spokesman thinks are not investing because they might have to arbitrate if they have a dispute.

Two additional points - lets focus here - there are millions of investors with millions of accounts. There were less than 5,000 arbitrations filed last year. The percentage of investors who are impacted by this is miniscule.

Second, the fact that arbitration is more efficient and reaches resolution in less time than a court case does not make arbitration "expedited" and certainly does not mean that investors cannot obtain relief. Arbitration panels award millions of dollars to investors every year.

Are taxpayer dollars really going to be used to enact legislation that affects a handful of people to prevent the uses of agreements that the Supreme Court has already ruled are valid and constitutional?

The attorneys at my firm represent investors, brokers and firms in securities arbitrations and in securities enforcement proceedings. For a free telephon consultation regarding your securities law issue, call us at 212-509-6544 or send an email to astarita@beamlaw.com

Friday, March 8, 2013

Crunch time

David, Jim, Peter and Rick are after the same question in my last WSJ oped and Blog post: Suppose the Fed wants to raise interest rates with a huge debt outstanding. With, say, $18 trillion outstanding, raising interest rates to 5% means raising the deficit by $900 billion a year. That's real fiscal resources. In a present value sense, monetary tightening costs someone $900 billion a year of taxes. There is no chance that current tax revenues can go up that much, or current spending can go down that much. So, raising interest rates to 5% with a lot of debt outstanding means we will borrow it, the debt will grow $900 billion a year faster, and the larger taxes /lower spending will come someday in the far off future.

Or maybe not. David, Jim, Peter and Rick delve in to the "tipping point" I alluded to.

Countries with high debt loads are vulnerable to an adverse feedback loop in which doubts by lenders about fiscal sustainability lead to higher government bond rates, which in turn make debt problems more severe.

Southern Europe was basically on a similar death spiral until the ECB stepped in and said it would print euros to buy up any debt as needed. The big contribution of the paper: facts.

Using statistical methods, case studies and a wealth of recent data on fiscal crises, we have found that countries with gross debt above 80% of GDP and persistent current-account deficits—as is currently the case in the United States—face sharply increasing risk of escalating interest payments on their debt. This means even higher budget deficits and debt levels and could lead to a fiscal crunch—a point where government bond rates shoot up and a funding crisis ensues.The vitally important point: it's nonlinear. Evidence from times and countries with lower debts does not apply.

When the Fed raised real rates in the late 1970s, Federal debt was “only” 32% of GDP. Interest payments did swell, from 1.5% to 3% of GDP, accounting for more than half of the Reagan deficits. And long-term real interest rates were high for a decade, usually interpreted as the market's worry that we would go back to inflation, which is the same thing as saying that the government might not have the stomach to pay off all this debt. But strong growth and tax reform led the US to large primary surpluses, and we paid off that extra debt.

We go in to this one with over 100% debt to GDP ratio, and much weaker growth prospects. The experience of how "easy" tightening was in the early 1980s should not lull us in to a sense of security.

They made a small, but I think crucial omission:

With sufficient political will, the U.S. government can avoid fiscal dominance and achieve long-run budget sustainability by gradually reining in spending on entitlement programs such as Medicare, Medicaid and Social Security, while increasing tax revenue by broadening the base.Quiz question: What's missing here?

Growth. Tax revenue = tax rate x income. You can broaden the base as much as you want, without economic growth the long-term US budget is a disaster. And the current alarming projections assume that we will, someday, return to strong growth. All the reining in, soaking the rich, and base broadening in the world will not save us without growth. We prescribe "structural reform" for Greece. Why not for the US?

Note to graduate students. The theory here is actually less well worked out than you think. Suppose the Fed follows a Taylor rule, hoping to control inflation by raising interest rates when inflation breaks out. But suppose there is a Laffer limit on taxes, total tax revenue is less than T. In this paper and my own speculations there is a conjecture that inflation can get out of control, and a sense of multiple run-prone equilibria, and a sense that current debt/GDP is an important state variable. It needs better working out.

Wednesday, March 6, 2013

Reviewing Advisor Custody Issues

The SEC found that a significant number of firms did not even realize that they had "custody" of a client's funds or securities within the meaning of the custody rule (Rule 206(4)-2 under the Advisers Act). According to the Alert, the SEC found advisors failing to comply with the custody rule in the following circumstances:

- The Role of Employees or Related Persons:The adviser’s personnel or a “related person” serve as trustee or have been granted power of attorney for client accounts.

- Bill Paying Services: The adviser provides bill-paying services for clients and, therefore, is authorized to withdraw funds or securities from the client’s account

- Online Access to Client Accounts: The adviser manages portfolios by directly accessing online accounts using clients’ personal usernames and passwords without restrictions and, therefore, has the ability to withdraw funds and securities from the clients’ accounts

- Adviser Acts as a General Partner: The adviser serves as the general partner of a limited partnership or holds a comparable position for a different type of pooled investment vehicle.

- Physical Possession of Assets: The adviser has physical possession of client assets, such as securities certificates.

- Check Writing Authority: The adviser or a related person has signatory and check writing authority for client accounts.

- Receipt of Checks Made to Clients: The adviser received checks made out to clients and failed to return them promptly to the sender

If you have any questions or concerns regarding compliance with the custody rule, or any other rule or regulation under the Investment Advisers, send us an email. Our attorneys have decades of experience in securities regulation and compliance and include former in-house attorneys and former SEC enforcement attorneys. Email us at astarita@beamlaw.com with your questions or concerns.

Comic of the day

Perhaps it's in need of a better caption. To be fair to Keynesian economics, perhaps the caption should continue,

"When you're done, another half a box will magically appear on the wall."

Maybe this is a good time for a cartoon caption contest!

Tuesday, March 5, 2013

Advisors Beware - Expect More SEC Civil Actions

The SEC has 5 years from the date that a fraud occurs to bring a proceeding. The SEC has argued in the courts that it should be given the benefit of what is known as the "discovery rule" which allows a civil plaintiff, such as a customer, to bring a fraud claim two years after the fraud was discovered. The decision, which is available at the Supreme Court's website, held that the time limit was 5 years from the fraud, no extensions in SEC cases.

The lower courts had been split on the issue, so the decision is welcome clarity for potential defendants who have been left in limbo while the Commission investigates. However, there is a new issue - the potential for a flood of SEC cases arising from the financial meltdown of 2008.

The statute of limitations for the SEC civil actions is starting to run now. Some potential defendants have undoubtedly avoided the penalties, as frauds that came to light in 2008 may have been committed in 2007. However, we can also expect the Commission to start filing cases in a flurry, to avoid the potential dismissal on statute of limitations grounds.

The attorneys associated with my firm include veteran litigators and former SEC enforcement attorneys. For a free consultation with one of our attorneys regarding any securities fraud proceeding, email us at astarita@beamlaw.com, or call 212-509-6544. We represent investors and financial professionals nationwide.

Sunday, March 3, 2013

Monetary policy with large debts

Sooner or later, the Federal Reserve will want to raise interest rates. Maybe next year. Maybe when unemployment declines below 6.5%. Maybe when inflation creeps up to 3%. But it will happen.

Can the Fed tighten without shedding much of the record $3 trillion of Treasury bonds and mortgage-backed securities on its balance sheet, and soaking up $2 trillion of excess reserves? Yes. The Fed can easily raise short-term interest rates by changing the rate it pays banks on reserves and the discount rate at which it lends.

But this comforting thought leaves out a vital consideration: Monetary policy depends on fiscal policy in an era of large debts and deficits. Suppose that the Fed raises interest rates to 5% over the next few years. This is a reversion to normal, not a big tightening. Yet with $18 trillion of debt outstanding, the federal government will have to pay $900 billion more in annual interest.

Will Congress and the public really agree to spend $900 billion a year for monetary tightening? Or will Congress simply command the Fed to keep down interest payments, as it did after World War II, reasoning that "Fed independence" isn't worth that huge sum of money?

This additional expenditure would double the deficit, which tempts a tipping point. Bond markets can accept fairly big temporary deficits without charging higher interest rates—buyers understand that bigger deficits for a few years can be made up by slightly larger tax revenues or spending cuts over decades to follow. But once markets sense that deficits may be unsustainable, and that bond buyers may face default, restructuring or inflation, they will demand still-higher interest rates. Higher rates mean higher deficits—leading to a fiscal death spiral.

Many economists think the tipping point starts when total government debt (federal, state and local) exceeds 90% of GDP. We are past that value, with large state and local debts, continuing sclerotic growth and a looming entitlements crisis to boot. This, not the "balance sheet" or other monetary or institutional constraints, will be the Fed's quandary—can the monetary authority really dare to risk a fiscal crisis?

The obvious answer is to fix the long-run deficit problem, with the reform of runaway spending, entitlement programs and a pro-growth tax policy. So far that is not happening.

Still, the Fed and the Treasury can buy a lot of time by lengthening the maturity of U.S. debt. Suppose all U.S. debt were converted to 30-year bonds. Then, if interest rates rose, Treasury would pay no more on its outstanding debt for 30 years. And if the country couldn't solve its fiscal problems by that time, it would deserve a Greek crisis.

| |

| Maturity structure of US debt. |

Mr. and Mrs. Smith shopping for a mortgage understand this trade-off. Mr. Smith: "Let's get the adjustable rate, we only have to pay 1%." Mrs. Smith: "No, honey, that is just the teaser rate. If we get the 30-year fixed at 3%, then we won't get kicked out of the house if rates go up."

Amazingly, nobody in the federal government is thinking about this trade-off. Instead, each agency thinks only for itself.

The Fed is still buying long-term bonds in an effort to temporarily drive down long-term interest rates by a few basis points. It has concluded it can survive the loss in mark-to-market value of its bond portfolio that higher interest rates will imply, when they come, by suspending its customary interest-rebate payments to the Treasury. If the Treasury was counting on that roughly $80 billion per year, that is Treasury's problem. If higher rates cost the Treasury $900 billion a year, that is Congress's problem.

The Treasury's Bureau of Public Debt controls the maturity of federal debt issues. It has been gently borrowing longer in response to low long-term rates, but not enough to substantially alter the government's interest-rate risk. The bureau also views its job narrowly—which is to finance whatever deficits Congress determines, not to take actions that mitigate future deficits. Congress and the administration are busy with other matters.

Ironically, the Fed's buying and the Treasury bureau's selling have neatly offset, leaving very little change in the maturity structure of debt in private hands.

What to do? First, the Treasury and Fed need a new "accord" to decide who is in charge of interest-rate risk, most likely the Treasury, and then grant it clear legal authority to manage that risk. The Fed should then swap its portfolio of long-term bonds for a portfolio of short-term Treasuries and forswear meddling in the maturity structure again.

Second, the Treasury should seize its once-in-a lifetime opportunity to go long. Thirty-year interest rates are at 2.8%, a 60-year low. Many corporations and homeowners are borrowing long to lock in low funding costs. So should the Treasury.

You may complain that if the Treasury borrows long, then long-term rates will rise. If so, it is better that everyone knows that now. It means that markets aren't really willing to buy long-term government debt, that the 2.8% yield is only a fiction of the Fed's current buying, and that it won't last long anyway. Better fix the fiscal hole, fast.

[WSJ cut: Moreover, if buying and selling a lot of bonds is a problem, the Treasury should engage in an aggressive swap program. In a swap, the Treasury pays a counterparty a fixed rate (say, 2.8%) and receives floating rates, with no bond changing hands. The First Bank of Podunk uses swaps to manage interest rate risk, when it doesn’t want to buy and sell assets. So can the Treasury.

You may complain about counterparty risk. But swaps are collateralized, so each counterparty does not lose if the other one defaults. And if the thousands of pages of Dodd-Frank regulation, and the army of stress testers can’t ensure that too-big-to-fail banks properly manage simple interest rate risk, then we really should have a law-book bonfire. ]

You also may argue that 2.8% long term-debt is more expensive than 0.16% one-year debt. There are two fallacies here. First, the 2.8% long-term yield reflects an expectation that short rates will rise in the future, so the expected cost over 30 years, as well as the true annual cost, are much closer to the same. Second, to the extent that long-term bonds really do pay more interest over their life span, this is the premium for insurance. Sure, running a restaurant is cheaper if you don't pay fire insurance. Until there is a fire.

A much longer maturity structure for government debt will buy a lot of insurance at a very low premium. It will buy the Fed control over monetary policy and preserve its independence. If Fed officials realized the risks, they would be screaming for longer maturities now.

But we don't have long to act. All forecasts say long-term rates will rise soon. As the car dealer says, this is a great deal, but only for today.

Notes: See this earlier blog post or pdf essay for more. I hope to sell WSJ on the second part, keeping the balance sheet big and Treasury floating-rate debt, sometime soon.

If you think I'm pessimistic or making up numbers, here are the CBO's baseline budget projections

By 2023, the CBO thinks interest payments on the debt will be $857 billion, essentially the entire deficit! The CBO assumes (see p. 67 here) that interest rates start rising in 2016 and in 2018 stop at 4% one year and 5.2% ten year rates. What if the Fed really wants to tighten?

Moreover, the cheery forecast of return to a balanced primary budget relies on an assumption of spectacular growth (p. 68) -- 3 years of 4% growth bringing us back to "potential" (see p.36) -- in-your-dreams tax revenues, and the rosy-scenario "baseline" expenditure cuts. What if the primary deficit is also $900 billion dollars?

Friday, March 1, 2013

The banker's new clothes -- review

Bottom line: Banks should issue a lot more equity, a lot less debt, especially short term debt, and a heck of a lot less nonsense.

I admire Anat and Martin. The rest of us read the gobbledygook in the newspapers, chuckle at the faculty lunch -- "Ha ha, xyz is CEO of a huge bank and has never heard of Modigliani-Miller! Ha Ha -- pdq is a senior regulator, and doesn't know the difference between capital and reserves!" -- and then we go about our business. Anat and Martin have admirably taken the bull by the horns. They write opeds, they go to interminable banking policy conferences, they fight it out with bigwig bankers, regulators, and their consultant economists, and endure their scorn. This nice book summarizes their arguments very clearly (without the foaming at the mouth ranting and raving that I would have had a hard time avoiding in their place!)

(Links: This review at the Wall Street Journal (html), in a pdf from my webpage. Admati and Hellwig have a book website with lots of extra material and response to critics.)

Enough preamble. The review:

Four and a half years ago, the large commercial banks nearly failed, inaugurating our great recession. They were saved by the Troubled Asset Relief Program, Federal Reserve lending and other government support. If you think all that was bad, imagine the ATMs going dark. What has been done to avoid a repetition of these events? Sadly, and despite all the noise you hear about bank regulation, not much.

The central problem, at the core of Anat Admati and Martin Hellwig's "The Bankers' New Clothes," is capital.

In order to make $100 of loans, a typical bank borrows $97—from depositors, from money-market funds, from other banks, or from bondholders—and sells $3 of stock, its "capital." So if only 4% of the bank's loans fail, the shareholders are wiped out, and the bank cannot pay its debts. Worse, if there is a rumor that some loans are in trouble, creditors may "run," each trying to get his money out first, and force a needless bankruptcy. Think of Jimmy Stewart in "It's a Wonderful Life."

When banks are on the brink, all sorts of other pathologies emerge. Bankers and their regulators may try to keep zombie loans on the books, hoping things will turn around. Or bankers may bet the farm on very risky loans that either save the bank or impose larger losses on creditors and the government. Ms. Admati and Mr. Hellwig explain all this nicely in their first few chapters.

The solution seems pretty obvious, no? Banks should fund their investments by selling a heck of a lot more stock and borrowing a heck of a lot less, especially in the form of run-prone short-term debt, as most other companies do.

Far more value was lost in the 2000 tech bust, for instance, than in the subprime mortgages that sparked the 2008 crisis, but the tech bust did not cause a financial crisis. Why? Tech companies were funded by stocks, not short-term debt. Worried shareholders can drive down the price of a stock, but they have no right to demand that the company redeem shares at yesterday's price, so they can't drive the company to bankruptcy in a run. Depositors and other short-term creditors have a fixed-value, first-come-first-serve promise from a bank—they can run.

More capital and less debt would stabilize the financial system in many ways. If a bank wants to rebuild its ratio of capital to assets from 1% to 2% by selling assets, it has to sell half of its assets. Doing so can spark a fire sale, especially if all the other banks are doing the same thing. If the same bank wants to rebuild capital from 49% to 50% of assets, it only has to sell 2% of its assets. That bank will also have a far easier time issuing more stock, rather than selling assets, which is a better way to build equity in the first place.

The U.S. government has instead addressed the risks of banking crises by guaranteeing bank debt. Guaranteeing debts creates perverse incentives, so our government tries to regulate the banks from taking excessive risks: "OK, cousin Louie, I'll cosign the loan for your Las Vegas trip, but no poker this time, and be in bed by 10."

Ms. Admati and Mr. Hellwig show how this approach has failed, repeatedly, over the course of many years—in the 1984 Continental Illinois rescue; in the Latin American debt crisis and savings-and-loan crisis in the 1980s; in the Asian-currency crisis and the collapse of Long-Term Capital Management in the 1990s; and in the recent financial crisis. Each time, our government bailed out more and more creditors in a wider array of institutions. Each time, our government wrote reams of new rules that banks quickly got around.

Now pretty much all of the big banks' debt is guaranteed, explicitly or implicitly through the widely held expectation that a big bank's creditors will be bailed out. But our regulators promise that next time, trust them, they really will spot trouble ahead and do something to stop it—even though our massive bank-regulation machinery failed to notice that subprime mortgages might be a bit risky in 2006 and even though, as Ms. Admati and Mr. Hellwig note, Europe's regulators still consider Greek government bonds to be risk-free assets.

Most basically, Ms. Admati and Mr. Hellwig point out that current regulation is focused on a bank's assets: the loans, securities and other investments that bring money in (and sometimes don't). They want us to focus instead on the bank's liabilities: the ways banks get money and the promises banks make to depositors and investors. Bank assets are not particularly risky or illiquid. Apple's profits from selling iPhones or a mutual fund's portfolio of stocks are far riskier than any bank's portfolio of loans and mortgage-backed securities, or even their much-disparaged trading books. Bank liabilities—too much debt and too much short-term debt—are the central problem that causes financial crises.

What about those "tough" new capital regulations that you keep reading about? They are not nearly as tough as you think. At best, the new Basel III international bank regulation agreement calls for a 7% ratio of capital to assets by a leisurely 2019 deadline. But that is the ratio of capital to "risk-weighted" assets. Risk-weighting is a complex system in which some assets count less against capital requirements than others. A dollar of mortgage assets might count as 50 cents, but it might count as 10 cents or less if it is a complex mortgage-backed security, and zero if it is government debt. When Ms. Admati and Mr. Hellwig unravel those "risk weights," we're still talking about 2% to 3% actual capital.

Foreseeing the usual risk-weighting games, Basel III requires a backstop 3% ratio of equity to all assets. "If this number looks outrageously low," Ms. Admati and Mr. Hellwig write, "it is because the number is outrageously low." Indeed.

This simple truth has been met by howls of protest and layers of obfuscation and derision by bankers, their consultants and many of their regulators. "Oh, you just don't understand the complexities of banking" is the basic attitude. "Go away and let the experts fix this." Well, Ms. Admati and Mr. Hellwig, top-notch academic financial economists, do understand the complexities of banking, and they helpfully slice through the bankers' self-serving nonsense. Demolishing these fallacies is the central point of "The Bankers' New Clothes."

No, they write, it was not always thus. In the 19th century, banks funded themselves with 40% to 50% capital. Depositors wouldn't lend to banks unless the banks had a lot of skin in the game. Without a government debt guarantee—and, early on, without limited liability—shareholders wanted less risk as well.

"Capital" is not "reserves," and requiring more capital does not reduce funds available for lending. Capital is a source of money, not a use of money. When, as Ms. Admati and Mr. Hellwig gleefully note, the British Bankers' Association complained in 2010 about regulations that would require banks to "hold"—the wrong verb—"an extra $600 billion of capital that might otherwise have been deployed as loans to businesses or households," it made an argument both "nonsensical and false," contradicting basic facts of a bank balance sheet. Requiring more capital does not require banks to raise one cent more money in order to make a loan. For every extra dollar of stock the bank must issue, it need borrow one dollar less.

Capital is not an inherently more expensive source of funds than debt. Banks have to promise stockholders high returns only because bank stock is risky. If banks issued much more stock, the authors patiently explain, banks' stock would be much less risky and their cost of capital lower. "Stocks" with bond-like risk need pay only bond-like returns. Investors who desire higher risk and returns can do their own leveraging—without government guarantees, thank you very much—to buy such stocks.

Nothing inherent in banking requires banks to borrow money rather than issue equity. Banks could also raise capital by retaining earnings and forgoing dividends, just as Microsoft MSFT +0.54% did for years. Every dividend drains capital from banks and removes a layer of protection between us taxpayers and the next bailout. Ms. Admati and Mr. Hellwig are at their best in decrying U.S. regulators' decision to let banks pay dividends in 2007-08—amounting to half the TARP bailouts—and to let big banks begin paying out dividends again in 2011.

Why do banks and protective regulators howl so loudly at these simple suggestions? As Ms. Admati and Mr. Hellwig detail in their chapter "Sweet Subsidies," it's because bank debt is highly subsidized, and leverage increases the value of the subsidies to management and shareholders. To borrow without the government guarantees and expected bailouts, a bank with 3% capital would have to offer very high interest rates—rates that would make equity look cheap. Equity is expensive to banks only because it dilutes the subsidies they get from the government. That's exactly why increasing bank equity would be cheap for taxpayers and the economy, to say nothing of removing the costs of occasional crises.

And, in an all-too-short chapter on "The Politics of Banking," they show us how politicians and regulators like the cozy cronyism of the current system. Banks are, of course, "where the money is," and governments around the world use regulation to direct funds to politically favored businesses, to preferred industries, to homeowners and to the government itself. Politicians want to subsidize and protect their piggy bank. Regulators commonly become sympathetic to the interests of the industry they regulate, which advances their careers in government or back in industry. Last week's news coverage of Treasury Secretary Jack Lew's interesting career is only the most recent reminder.

Part of me wishes that Ms. Admati and Mr. Hellwig had been more specific in their criticisms: naming more names and quoting more nonsense, writing a gripping exposé dripping with their justified outrage. But their restraint is wise: Too much exposé would detract from the clarity of their ideas. So readers will have to recognize the arguments and add their own outrage.

Ms. Admati and Mr. Hellwig do not offer a detailed regulatory plan. They don't even advocate a precise number for bank capital, beyond a parenthetical suggestion that banks could get to 20% or 30% quickly by cutting dividend payments. (I would go further: Their ideas justify 50% or even 100%: When you swipe your ATM card, you could just sell $50 of bank stock.)

But this apparent omission, too, is a strength. A long, detailed regulatory proposal would simply distract us from the clear, central argument of "The Bankers' New Clothes": More capital and less debt, especially short-term debt, equals fewer crises, and common contrary arguments are nonsense. More capital would be far more effective at preventing crises than the tens of thousands of pages of Dodd-Frank regulations and its army of regulators, burrowed deep in the financial system, on a hopeless quest to keep highly leveraged and subsidized too-big-to-fail banks from taking too much risk. Once the rest of us accept this central idea, the details fill in naturally.

How much capital should banks issue? Enough so that it doesn't matter! Enough so that we never, ever hear again the cry that "banks need to be recapitalized" (at taxpayer expense)!

(Update in response to a lot of comments. C'mon, this is a review of a book about banks. It's not my place here to expand the discussion to GSEs' CRA, the run on repo and broker dealers, money market funds etc. On the ATM card that sells bank stock: That card can also sell a share of your S&P500 index. And if you want stable value accounts, money market funds that hold only short term treasuries can provide all the fixed-value assets we could possibly want.)

Limited clairvoyance

In this context, a lovely little piece at "The American" AEI's online magazine, caught my eye, Alex Pollock's "The housing Bubble and the Limits of Human Knowledge"

An excerpt:

Consider the lessons of the following 10 quotations:

1. About whether Fannie and Freddie’s debt was backed by the government: “There is no guarantee. There’s no explicit guarantee. There’s no implicit guarantee. There’s no wink-and-nod guarantee. Invest and you’re on your own.” — Barney Frank, senior Democratic congressman, notable Fannie supporter, later chairman of the House Financial Services Committee

It would be difficult to imagine a statement more wrong.

2. “We do not believe there is any government guarantee, and we go out of our way to say there is not a government guarantee.” — John Snow, Republican and secretary of the Treasury

Saying it did not make it so, unfortunately.

3. “The facts are that Fannie and Freddie are in sound situations.” — Christopher Dodd, senior Democratic senator, prominent Fannie supporter, chairman of the Senate Banking Committee

Pronounced two months before Fannie and Freddie collapsed.

4. “We have no plans to insert money into either of those two institutions [Fannie and Freddie].” — Henry Paulson, Republican and secretary of the Treasury

Stated one month before the Treasury started inserting money into Fannie and Freddie.

Ordinary Americans are being taxed so that foreign and domestic bondholders get back every penny they lent Fannie and Freddie.

5. “Home prices could recede. A sharp decline, the consequences of a bursting bubble, however, seems most unlikely.” — Alan Greenspan, chairman of the Federal Reserve Board

The common wisdom of the bubble years. At the time of this statement in 2003, the Fed was in the process of dramatically reducing short-term interest rates and stimulating house-price increases.

6. “Global economic risks [have] declined.” — International Monetary Fund

Observed four months before the international financial panic started in August 2007.

7. “More than 99 percent of all insured institutions met or exceeded the requirements of the highest regulatory capital standards.” — Federal Deposit Insurance Corporation

This statement was made in the second quarter of 2006, at the peak of the housing bubble. More than 400 such institutions later failed and others were bailed out in the ensuing bust. The FDIC failed its own required capital ratio, reporting negative net worth.

8. “The risk to the government from a potential default on GSE [Fannie and Freddie] debt is effectively zero.” — Joseph Stiglitz, Nobel Prize–winning economist, Peter Orszag, a future White House budget director, and Jonathan Orszag

Conclusion after considering “millions of potential future scenarios” — but obviously not the scenario which then actually happened.

9. "'Not only didn’t we see it coming,' but once the crisis started, central bankers 'had trouble' understanding what was happening." — Remarks by Donald Kohn, vice chairman of the Federal Reserve Board

A candid statement of the truth.

10. Finally: “Libenter homines id quod volunt credunt.” That is: “People easily believe that which they want to believe.” — Julius Caesar

Nothing has changed in this respect since Caesar’s day, and his dictum applies to government officials, central bankers, economists, and experts — just as it does to you and me.